Malta Individual Investor Program

Officially known as the Malta Individual Investor Program, the Malta citizenship by investment scheme was first introduced in 2014, aimed at attracting the investment of high-net-worth individuals of good moral standing. Each year over 1,000 investors are granted citizenship in Malta through the program.

| Item of expenditure | Current Malta citizenship program for investment | New Malta citizenship program through residence |

|---|---|---|

| Minimum investment amount | €650, thousand to Malta Development Fund €150, thousand in government bonds | €750, thousand, if one year has passed since the registration of the residence** €600, thousand if it’s been 3 years since the residency was issued** €10, thousand – charity donation |

| Investments for citizenship for family members | €25, thousand per spouse and children under 18 years of age €50, thousand for children over 18 years and parents | €50, thousand for each dependent |

| Purchasing property* | €350, thousand | €700, thousand |

| Rent a property for 5 years, the cost per year* | €16, thousand | €18 thousand |

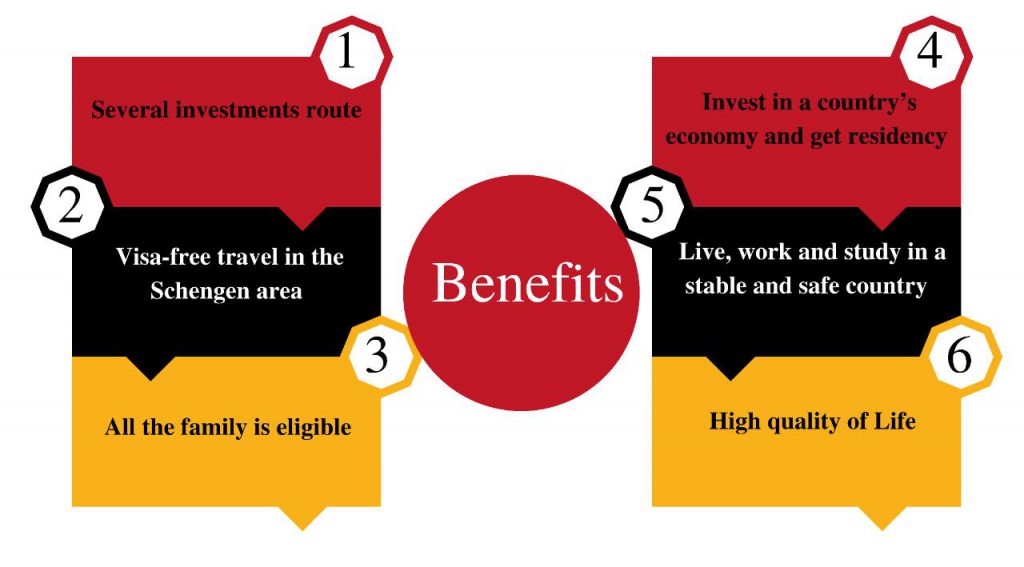

1 – Freedom of movement within the EU

Malta is a full member of the EU, which means investors who acquire Maltese citizenship are entitled to live and work anywhere in Europe. Malta also lies within the Schengen Zone, meaning there are no visas or passport checks when traveling within the European Schengen Zone countries.

2 – Visa-free travel

The Malta passport is one of the strongest in the world, and besides freedom of movement and visa-free travel within Europe, a Maltese passport also allows visa-free travel to 168 countries worldwide.

3 – Obtain citizenship in Malta fast

Another key benefit of Maltese citizenship by investment is that it allows investors to obtain citizenship within a much shorter timeframe than other citizenship by investment programs in separate countries. You can obtain Maltese citizenship in just one year.

4 – Passports for your whole family

Investing in Maltese citizenship means you can obtain a European passport not just for yourself, but also for the rest of your family. Do note that extra contributions must be made for dependents to obtain citizenship alongside the main applicant. Children born to Maltese citizens also automatically get citizenship, so your children and grandchildren will inherit Maltese nationality for life.

5 – Tax efficiency

Malta’s tax system is based upon residency, not citizenship, meaning that you may not have to pay tax in Malta even if you obtain citizenship. Malta also has special tax schemes for new citizens which can result in additional tax efficiency.

6 – Stable and secure country

Malta has one of the highest GDPs in Europe and one of the lowest unemployment rates. It’s also regarded as one of the safest countries in Europe.

7 – Quick processing times

Unlike other citizenship by investment programs, Malta has a relatively quick processing time, which can lead to investors obtaining citizenship in a year.

In order to be eligible for the Malta Individual Investor Programme, you must:

- Be over the age of 18

- Have a clean criminal record

Meet the minimum investment threshold

- “Fit and proper” test

The Maltese government requires all applicants for Malta citizenship by investment to pass the “fit and proper” test. This involves a thorough background check to ensure that investors hold no criminal records and the due diligence checks are done by INTERPOL and the International Criminal Court. You are also required to submit a criminal record from the police in your country of origin.

- Good health

Applicants for Malta citizenship by investment must show that they are in good health, and must also be covered by an international health insurance policy.

- Biometric data

Upon applying for Malta citizenship by investment, it is essential that all investors and their dependents provide biometric data to the Maltese government.

| Due diligence fees | Passport fees | Bank charges |

|---|---|---|

| • €7,500 for the main investor • €5,000 for spouse and other dependents • €3,000 for children between the ages of 13 and 18 | • €500 per person | • €200 per application |

- It is also important that investors from Malta’s citizenship by investment scheme know that the state has:

- No inheritance tax

- No estate duty

- No wealth tax

- No municipal taxes

No property ownership tax